Liquidation

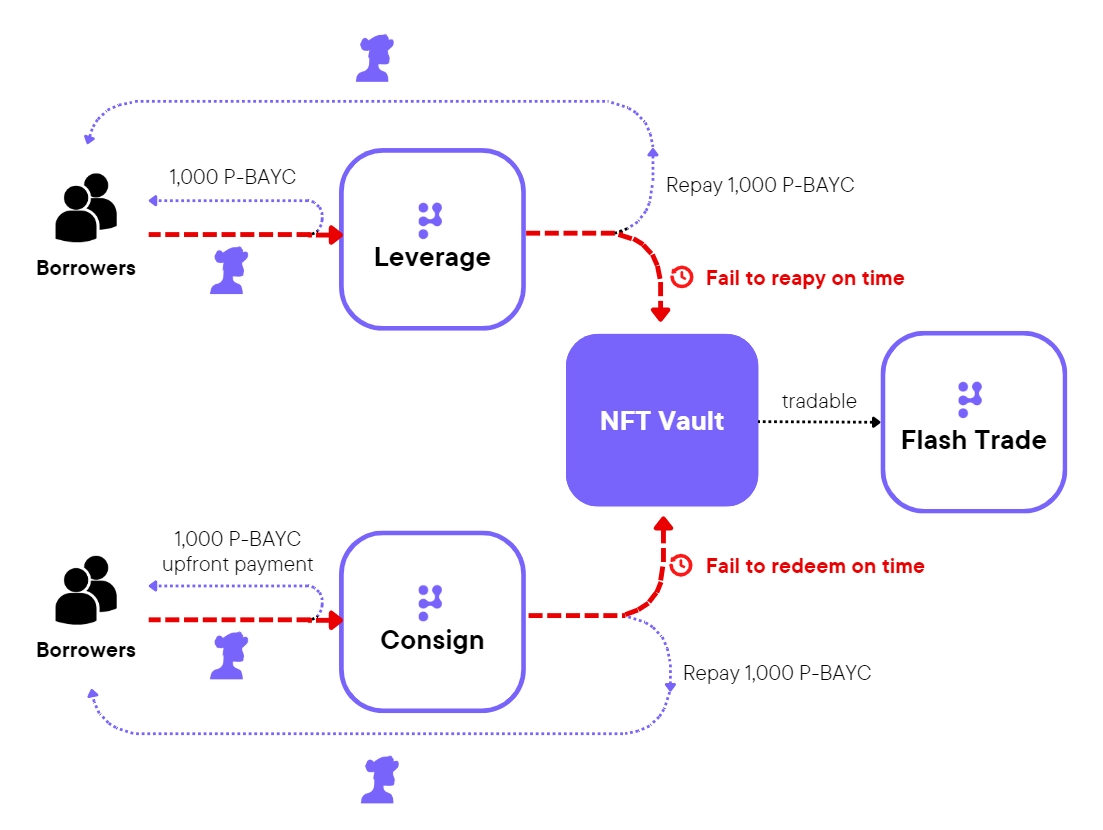

NFT Leverage

At Polarise, we understand that borrowers may be vulnerable to liquidation risks caused by price volatility during the loan period. That's why we designed our NFT Leverage module to eliminate this risk. As a result, when borrowers borrow P-Token against their NFT, they can rest assured that they won't be liquidated due to market fluctuations during the loan period.

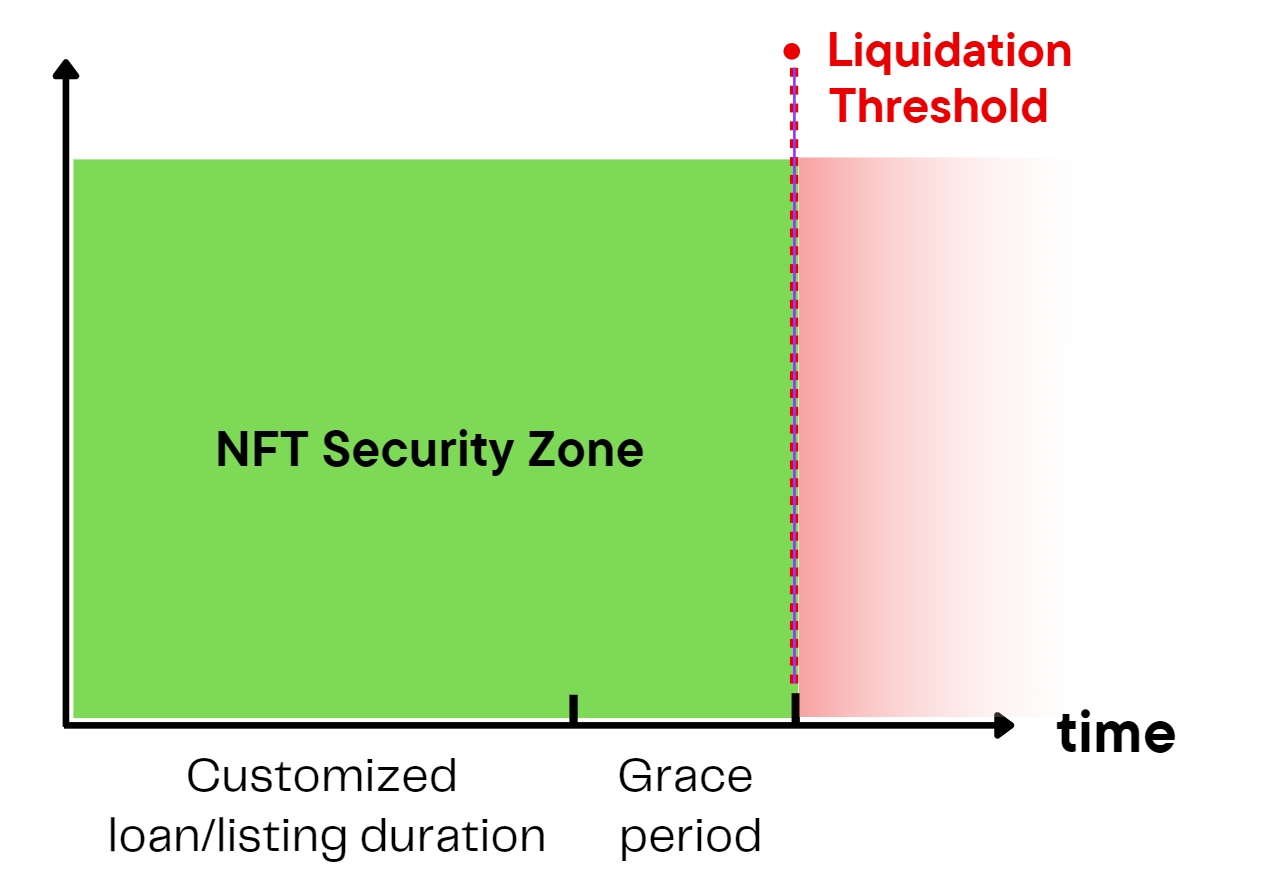

If borrowers repay the calculated P-Token amount before the loan expiration date, they can retrieve their NFT. However, if they miss the deadline, they will enter a grace period before liquidation. The grace period is equal to the loan duration multiplied by 0.2 (there is no grace period for ERC-1000 standard collections). For example, if the loan duration is 30 days, the borrower has until the 36th day to repay the loan before liquidation occurs. Please note that interest will still accrue during the grace period.

At Polarise, we prioritize the security and convenience of our users. Our NFT Leverage module offers flexible loan terms and eliminates the risk of liquidation, making it a reliable option for borrowers looking to leverage their NFTs.

The liquidated NFT will be directly sent to "NFT Vault" for trading. See Flash Trade for more details.

Consignment

Consignment has the same liquidation logic as NFT Leverage. Sellers must pay back the upfront payment and custody fee before the grace period ends.

The consigned NFT will also be liquidated if the seller does not pay back on time, and it will be directly sent to "NFT Vault" for trading.

Last updated