NFT Leverage

Obtain loan instantly without liquidation risk

While Flash Trade offers users the ability to buy and sell NFTs instantly, it does not guarantee that users can repurchase the same NFT, as other users from the vault may acquire it. To cater to the market demand of users seeking P-Token exposure without forfeiting their original NFT, Polarise introduces "NFT Leverage."

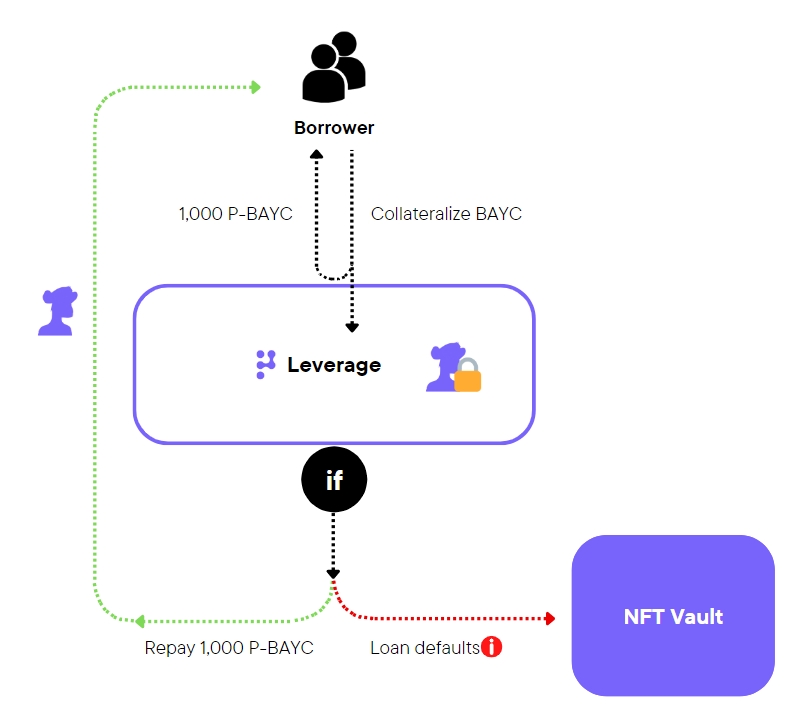

By pledging their NFTs as collateral, users can borrow corresponding P-Tokens, with a nearly 100% LTV. Notably, users are guaranteed to receive their original NFT back as soon as they repay the P-Tokens, which will be safeguarded in our audited and verified smart contract by PeckShield. NFT Leverage provides a secure and efficient means of obtaining P-Token exposure while retaining ownership of NFT assets.

Please note, Polarise's leverage mirrors the isolated margin lending structure - each NFT borrowing instance initiates a unique loan order, where interest and loan duration are calculated separately. So, for instance, if you aim to borrow against 10 NFTs, you need to open 10 individual leverage orders.

How to borrow out P-Tokens with NFTs?

Here is a step-by-step guide on how users can get short-term P-Tokens with their NFTs:

Go to "NFT Leverage" page, and select an NFT user would like to borrow against (our front-end will be displaying only supported collections). In this example, the user select one of his "Bored Ape Yacht Club"

Select a duration in which user wishes to hold this position. In this case, 30 days.

There will be a 10% annual margin rate deducted from the leverage amount, which is 1,000 P-BAYC, as an upfront interest. That is, user will receive 1,000 x (1 - 10% x 30/365) = 991.78 P-BAYC

After approval, 991.78 P-BAYC will be sent to user's wallet, and the BAYC will be locked in the Leverage Contract.

To get back user's leveraged BAYC after N days, he/ she needs to pay back 991.78 +1,000 x (10% x N/365)

After approval, the original BAYC will be sent back to user wallet.

Please note that margin rate might be changed due to market condition or through a successful Polarise Governance proposal.

Is there any benefit to borrow out P-Tokens with NFTs?

Of course! There are two main reasons borrowers should obtain liquidity through Polarise's leverage module: nearly 100% LTV and 0 risks of mid-term liquidation.

100% LTV

Even though the loan amount is calculated in P-Token, you can quickly settle in ETH through our smart router. Imagine borrowing 15 ETH against your Bored Ape with a 14 ETH floor price - this is an everyday use case in Polarise!

0 risk of mid-term liquidation

When borrowing P-Token against NFT in Polarise NFT Leverage module, borrowers will not be vulnerable to any liquidation risk due to price volatility during loan period. As long as borrowers pay back the calculated P-Token amount before expiration, they will be able to get back their NFT.

Unlike normal NFT lending platforms where borrowers are exposed to both ETH and NFT price volatility, Polarise will keep risk more manageable as the only exposure will be P-Token amount.

What if I did not pay back on time?

A default will happen when borrowers fail to repay the debt according to the above agreement. Please see more details in NFT Leverage Liquidation.